Pros and Cons of ATMs

In this article, we discuss the pros and cons of ATMs and how they impact the markets they serve. The ATM was introduced to deliver teller...

While our image for this article might make you chuckle, the question is a serious question that needs to be answered. We have written this article because it’s a common question that many of our current customers ask. I can say that each manufacturer has its own philosophy, and ultimately, quantity and total revenue of the deal can change the pricing dramatically depending on each individual situation. But we wanted to address several of the components that drive costs in these type of situations.

The island drive-up ATM is a nice way to reduce the need of expensive kiosks or buildings to house drive up ATMs. Here in the south, the vast majority of ATMs are drive-up. Factors that have become standard it seems for most manufacturers is a touchscreen interface. These typically range from 15”-21” based on model. The next question is capacity and how many cassettes you need dispensing. Most clients have gone one of two ways, either dispensing only $20s to reduce loads or dispensing 4 different denominations to allow greater customer choice and a more self-service banking solution. Most FI’s tend to go with 2 HIGH dispensers and the price to go up to 3 or 4 HIGH is usually around $1000-$1500 per module as an add-on. Most manufacturers use thermal printers, so ribbons don’t have to be changed. Also, the vast majority of FI’s have gone to DIP card readers and now SMART DIP card readers that support EMV cards. Many FIs had to deal with card capture and it became a headache as the machine aged to deal with captured cards and frustrated users. The market price for a base island ATM ranges from $26,000-$34,000 depending on vendor.

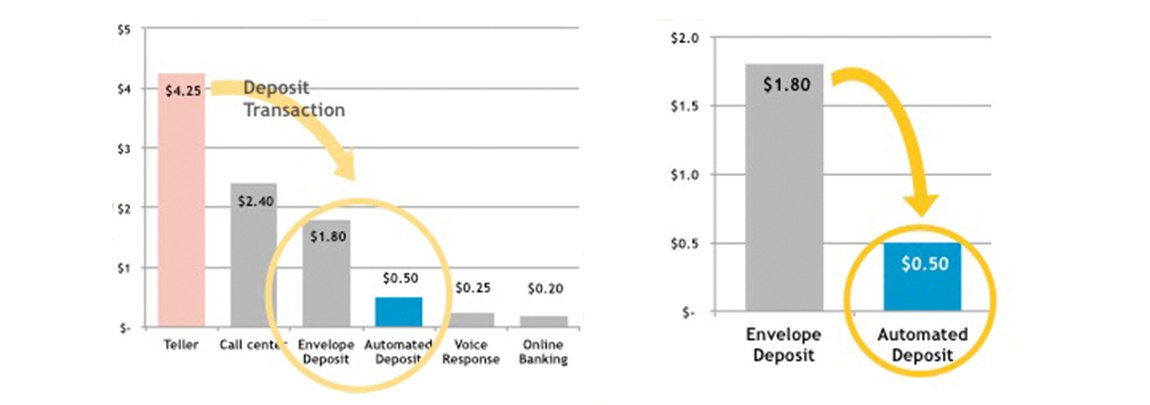

The next decision that controls the price is whether or not you plan to take deposits and will you do so with an envelope or imaging module. The envelope depository still has the largest market share, but is rapidly being replaced with either cash dispense only machines or deposit automation machines. The cost of handling envelopes at the ATM is prohibitive for the low volumes that most FI’s see at the ATM. Anticipate a cost increase of $1500-$2500 to add an envelope depository.

There has been a large movement to automating as much of the transaction flow at the branch as possible. Deposit automation reduces cost per transaction down to under .50. Deposit automation allows you to extend cutoff times, give instant credit on cash, and provide images on receipts that give customers proof that their deposit was received. It can also eliminate the hassle of processing deposits manually and issues where “empty” or “incorrect” amounts have been used to create some float for the customer over the weekend. Many FIs have already combatted this with policy, but it’s frustrating nonetheless. Deposit Automation increases the hardware cost in the range of $20,000-$30,000. There is also a backend process for getting the items from the ATM to your back office clearinghouse that carries a cost in the $15,000-$30,000 range depending on purchase or SAAS model.

Most companies will contract with a rigger to physically install the ATM on site. These ATMs weigh between 2000-3000lbs, so it requires a unique skill set to do this well and not damage the ATM. There is also a technical resource provided by the company to work with your ATM switch to make the communication magic happen and transactions possible. There is also the training on the ATM to make sure that staff know how to complete the majority of the functions associated with balancing, error clearance and general custodial duties. A typical price range for this service is $1500-$2500. Some companies may also charge separately for freight, which if you can imagine transporting 2000-3000 lbs around the country has a cost to it.

If you are really serious about bringing your customer experience to life and matching the rest of your branding, I highly recommend customized graphics for your screen. If you'd like more information about what this can do for your institution check out our article Financial Institutions War on Curbside Branding.

The median price for an Island Drive-up ATM is around $30,000, some are less and some are more. If you are looking into deposit automation the median price is around $50,000. Again, there are a variety of factors that influence pricing, but this gives you an idea of the ballpark to look in and how good a deal your quote really is.

.jpg)

In this article, we discuss the pros and cons of ATMs and how they impact the markets they serve. The ATM was introduced to deliver teller...

Let’s face it, managing ATMs can be challenging. It’s tough keeping up with repairs, technology advancements, and compliance, all while trying to...

Your branch or drive up ATM is past its prime and needs replacing. Or, you are building a new branch or establishing a presence in a new market and...