Whiteboard Videos: Episode 4 - Smart Safes 2.0

Whiteboard Videos: Episode 4 - Smart Safes 2.0 Smart safes can help deepen the banking relationship and offer additional value to your retail...

2 min read

Sean Farrell

:

Oct 12, 2015 7:30:00 AM

Sean Farrell

:

Oct 12, 2015 7:30:00 AM

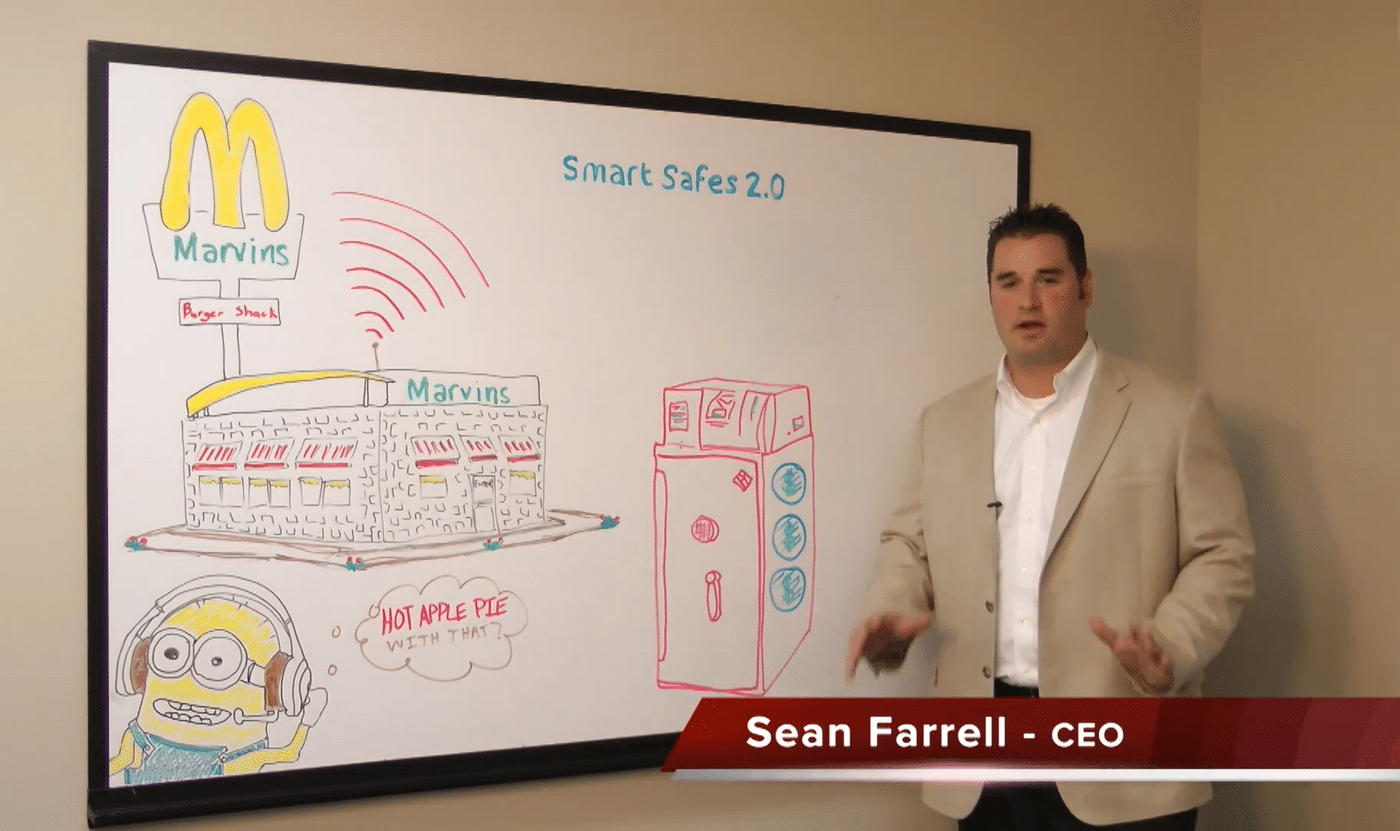

Two of the most common questions we answer from retailers are “What exactly is a smart safe?” and “How can it affect my retail operations?”

Those are great questions for anyone thinking about how they’re going to set up their cash handling processes because the Smart safe is the “backbone” of any retail operation that handles cash. In this article, we are going to discuss the points to consider when choosing a smart safe.

Today’s smart safes automatically accept, validate, record, and store cash in a secure environment. Smart safes will normally have the following characteristics:

So, here’s the skinny on streamlining your cash handling procedures. You don’t have to look far for the reasons as to why Smart safes are so widely used in the retail environment today. The most important benefit is reduction in the amount of time spent counting and handling money.

A key feature associated with smart safes that is widely unknown is that cash can go directly into a deposit bag or removable cartridge and does not need to be counted again until it reaches the bank. Money is typically counted a total of 6 times from the time the cashier receives it to the time it’s ready to go to the bank. Because of this feature, it is only being counted once.

Managers are spending less time counting money and preparing deposits. Accuracy improves and less time is spent reconciling deposits. Because of the connectivity and reporting features, partnering banks will issue provisional deposit credit based on the amount of cash deposited into the Smart safe.

Armored car companies even have services to pick up the deposits – totally eliminating the need for the manager to take the time to go to the bank. With the larger bills being deposited into the Smart safe, safety is also improved by reducing the amount of exposure to robbery. The list of benefits is virtually endless.

Let’s begin with the “Not So Skinny,” literally…Smart safes can be LARGE. Smart safes require much more space because of the actual components integrated into the safe itself that allow for all of the benefits and features. The actual physical placement of the smart safe within the retail operation can also be prohibitive.

Smart safes are typically installed near a central cashier station. For operations that have multiple cashier stations located over a large area, having multiple Smart safes can be cost prohibitive. Depending on the type of services that are offered, there can be ongoing costs associated with the service contract with the Armored Car Company and the bank providing the provisional deposits.

There is no disputing the fact that smart safes can streamline your cash handling processes. Hundreds of thousands of Smart safes are in operation in retail establishments all over the world today ranging from High End clothing stores to a booth at the local flea market.

To learn more about if a Smart Safe could be a good fit for your location, click here get in touch with the QDS team.

Whiteboard Videos: Episode 4 - Smart Safes 2.0 Smart safes can help deepen the banking relationship and offer additional value to your retail...

Automation Avenue Episode 10 - How Retail Cash Capture Will Grow Your Bank In this podcast episode we talk about the current market landscape for ...

As a business owner trying to make a sales goal and having enough money in your drawer, it can be quite annoying when people come into your business,...