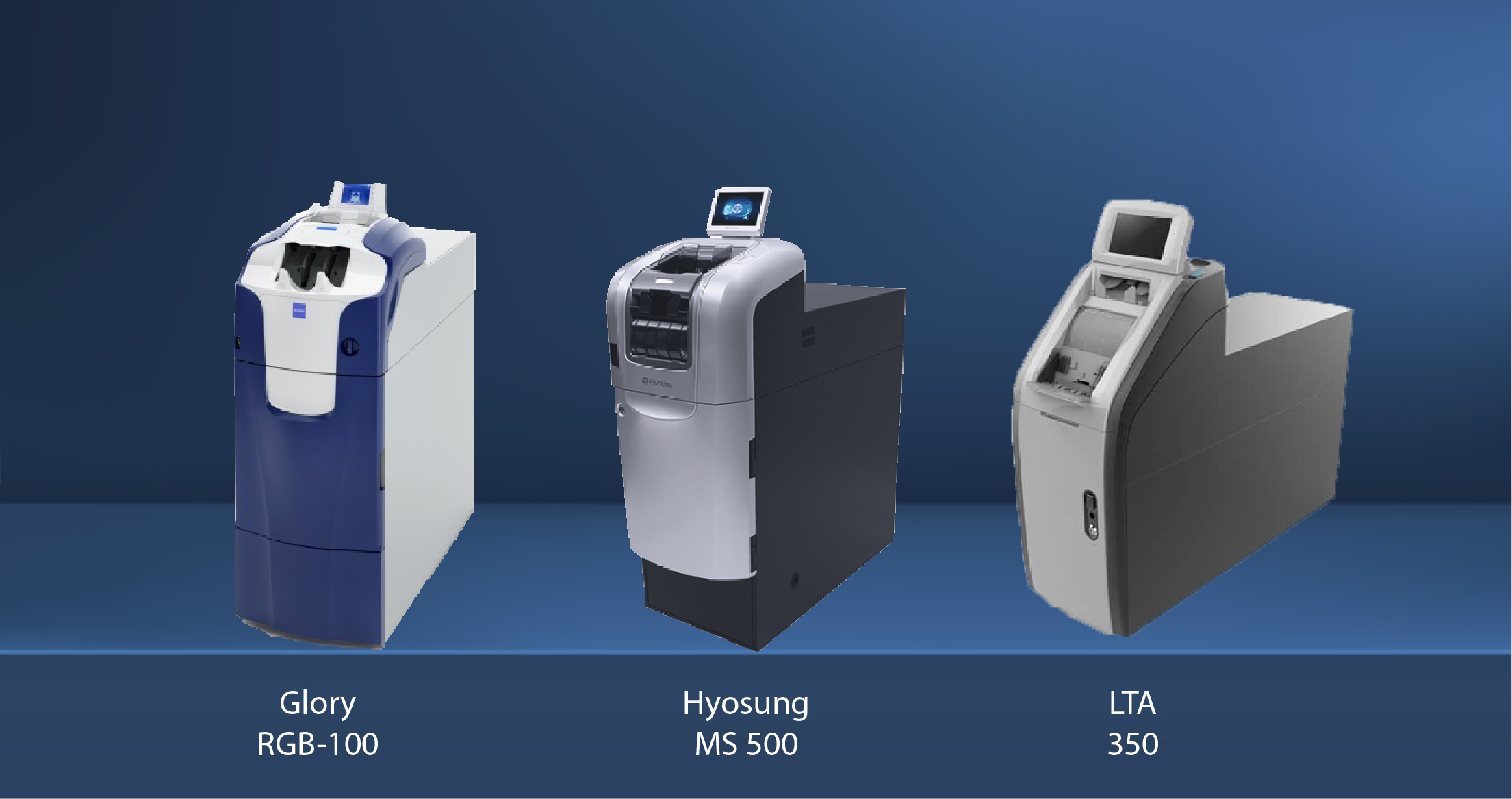

The 3 Best Cassette Based Teller Cash Recyclers (TCRs)

Glory RBG-100, Hyosung MS500 and ATEC LTA-350 Teller Cash Recyclers are picking up dramatic speed in implementation in the US market. Read more about...

4 min read

Sean Farrell

:

Sep 6, 2019 9:52:00 AM

Sean Farrell

:

Sep 6, 2019 9:52:00 AM

I will be honest, one of my greatest professional challenges is trying to convince customers that tried cash recyclers 10 years ago and possibly had a bad experience, to consider using the technology again.

“We tried those, we could’ve hand counted the money faster”

“It didn’t hold enough money, so we spent more time unloading the thing than anything else”

“The integration never worked right and we got out of balance and turned them off”

“Our board won’t even let us look at those again after our last experience”

These are not uncommon responses to some unsuccessful past experiences. However, if we look at the advances in technology that have come in the industry and other places, I think it might make sense to take another look at recyclers.

It would be like saying “The antenna on my StarTac phone used to always break, so I gave up on mobile phones.” Think about how far mobile phones have come since that time. So what has progressed with teller cash recycler technology and functionality? And why should you reconsider deploying cash recyclers or at least make the business case to senior management or the board?

One of the biggest hindrances to the success of cash recyclers was their lack of capacity. Many institutions were “sold” cash recyclers as THE solution to handle commercial deposits. But in the early days of recyclers, typical capacities were 4000-5000 notes and that simply wasn’t enough storage to handle the volume of a busy location that needed automation.

Today, multiple teller cash recyclers have capacities of over 10,000 notes, and some of them have overflow and transit cassette capability and their capacity can exceed those numbers. This allows for busy branches to better handle the peaks and valleys of commercial cash coming in. Also, I would argue that with better training, tellers can better identify the types of transactions that shouldn’t even be fed into the recycler.

Finally, the larger capacity allows for better cash management and fewer vault trips creating the potential for a 90%+ efficiency gain. Read more about this in our article How do I get my Head Teller Back. The sheer fact that today’s recyclers have double to almost triple the capacity is reason enough to reconsider the cash recycler.

One other common complaint was the slow speed of conducting cash recycler deposits. Many units deposited notes at 3-4 notes per second, required multiple batches, and required that rejected notes be handled at the end of the transaction. Because of that, smaller transactions could more than likely be handled faster by the person than the machine.

Today, there are multiple machines that run 8, 10, even 12 notes per second. Many of them have continuous feed (see our explanation on why continuous feed is a big deal), which means the teller can continuously process cash without stopping and can even deal with rejects as they happen, reducing transaction time. T

his, combined with larger capacity, allows most branches to fly through larger deposits from both commercial over the counter and night drop bags, which are two of the most time consuming transactions that institutions have to process. Larger transactions that were taking 15, 30, even 45 minutes to process are now completed in 5 minutes or less, dramatically improving efficiency and reducing customer wait time.

One of the biggest challenges of teller cash recyclers years ago was the limited options for integration and the reliability of middleware solutions to drive them. This area has seen monumental change, and personally I feel middleware is the best solution for your institution in the majority of cases.

There have been many improvements made to middleware over the years to better handle a variety of screen types and font changes. Our typical middleware has up to 7 different ways to integrate to the screen, allowing us to provide the most reliable solution to the end user as possible. “Screen scraping” has a negative connotation with most IT folks who remember the old days of middleware.

But today’s technology has improved much beyond how it used to be and we now use terms like “soft integration”, “field mapping”, or “middleware.” The fact that this part of the puzzle has improved so much means there is much less stress on software houses like Jack Henry and Fiserv to write integrations to the wide variety of TCRs currently available.

So you, as the institution, are now allowed to pick the best hardware for your situation and know that integration will work with any teller system out there, even the smaller ones.

With more FIs choosing open branch concepts, ITM technologies and other ways to more effectively engage their client base, TCRs have become a cornerstone to the Inside of the branch. FIs are focusing internal staff resources around advisement and relationship deepening.

With newer, more retail focused staff, the automation of the cash handling part, frees up the staff to focus on listening to the client, figuring out where to add value and suggest products that can solve the client needs. This dynamic Is much different than evaluating tellers on balancing to the penny for 25 years. While keeping the cash In balance Is Important the TCR handles the counting of cash, so errors are way more infrequent and lead to better client experience.

As many companies around the US are focusing on employees, employee safety has become a bigger driver for our clients. Not having employees load ATMs that are outside on the Island and also adding TCRs Inside, are ways to reduce overall employee exposure.

The TCRs Inside act as a deterrent, by securing almost all cash In a locked safe, many criminals are looking for quick and easy access to cash and are confused or frustrated by a large machine that seems to hold all the cash. Often the criminals will look for easier, more manual cash drawer type locations so they can be In and out In under 5 minutes.

TCRs also reduce overall exposure, especially In an open branch concept, by reducing open cash out exposed to clients. By combining continuous feed, with the Improved speed from above, cash deposit transactions can happen much faster and get loose cash secured even quicker. This functionality can also drive down overall Insurance premiums.

There are many branch transforming technologies on the market, but I strongly feel cash recyclers are one of THE best investments for your branch this year. If you’ve had a bad experience in the past, I really believe you should get out there and kick the tires again, because there are some GREAT solutions in the market today driving big efficiency gains for most institutions.

If you’d like someone to even talk to and see if it's right for your institution any more, click here to get in touch.

Glory RBG-100, Hyosung MS500 and ATEC LTA-350 Teller Cash Recyclers are picking up dramatic speed in implementation in the US market. Read more about...

There has been a huge increase in the discussion of teller cash recyclers for use in branches to aid in gaining efficienc. Teller Cash Recyclers can...

Personally, I have a lot of respect for what Arca has been able to build. A relatively unknown player in the market just 10 years ago, the company...